Understanding The United States Debt Clock: A Comprehensive Guide

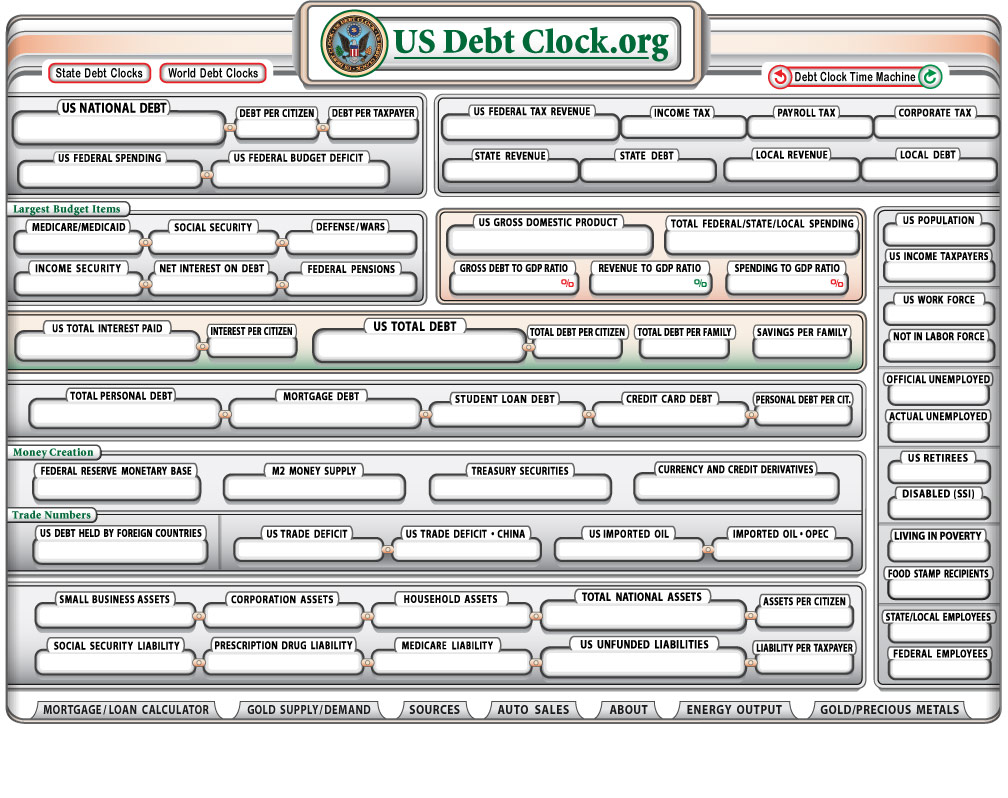

The United States Debt Clock has become an increasingly important topic for policymakers, economists, and the general public alike. This financial indicator tracks the cumulative debt of the U.S. government, providing a real-time snapshot of the nation’s fiscal health. As the numbers continue to rise, many are left wondering what this means for the future of the economy and the average American citizen. In this article, we delve into the intricacies of the debt clock, exploring its significance, the factors contributing to its growth, and potential solutions to address this growing concern.

For years, the United States Debt Clock has captured public attention, serving as both a warning sign and a call to action. The clock itself is a powerful visual representation of the nation’s financial obligations, updated in real-time to reflect changes in federal spending, revenue, and borrowing. By examining the underlying causes of the rising debt, we can better understand the long-term implications for economic stability, interest rates, and government programs.

As the U.S. government continues to borrow to fund its operations, the debt clock serves as a reminder of the need for responsible fiscal management. In this article, we will explore the history of the debt clock, its current status, and the potential consequences of unchecked debt growth. Additionally, we will examine strategies that policymakers and citizens can adopt to address this pressing issue, ensuring a more sustainable economic future for generations to come.

Read also:Diane Wildenstein The Intriguing Life Of Jocelyn Wildensteins Daughter

What is the United States Debt Clock?

The United States Debt Clock is a digital display that tracks the total public debt of the federal government. It provides a real-time update on the nation’s financial obligations, showcasing the balance between government spending and revenue. The clock is a critical tool for understanding the fiscal health of the country, as it highlights the growing gap between expenditures and income. By monitoring the debt clock, citizens and policymakers alike can gain insights into the challenges facing the U.S. economy.

Why Should You Care About the United States Debt Clock?

The significance of the United States Debt Clock extends beyond mere numbers. Rising debt levels can lead to increased interest payments, reduced government spending on essential programs, and potential inflationary pressures. These factors can have far-reaching consequences for the economy, impacting everything from job creation to consumer spending. Understanding the implications of the debt clock is crucial for anyone concerned about the long-term stability of the U.S. economy.

How Does the United States Debt Clock Work?

The functioning of the United States Debt Clock is relatively straightforward. It calculates the total public debt by adding up all outstanding obligations of the federal government, including both intragovernmental and publicly held debt. The clock updates in real-time, reflecting changes in government spending, revenue, and borrowing. By tracking these figures, the debt clock provides a transparent view of the nation’s financial position, enabling informed discussions about fiscal policy.

What Are the Main Causes of the United States Debt Clock’s Growth?

The growth of the United States Debt Clock can be attributed to several key factors. First, increased government spending on social programs, defense, and infrastructure has contributed significantly to the rising debt. Second, tax cuts and revenue shortfalls have further widened the fiscal gap. Finally, economic downturns and unforeseen events, such as the pandemic, have necessitated additional borrowing to stabilize the economy. Addressing these underlying causes is essential for stabilizing the debt clock and ensuring long-term economic sustainability.

Can the United States Debt Clock Be Reduced?

Reducing the United States Debt Clock requires a multifaceted approach that balances spending cuts, revenue increases, and economic growth. Policymakers must carefully evaluate the trade-offs between reducing deficits and maintaining essential services. Additionally, fostering a robust economy through investments in education, innovation, and infrastructure can help generate the revenue needed to pay down the debt. While the task is daunting, it is not impossible, provided there is a collective commitment to fiscal responsibility.

Is the United States Debt Clock a Cause for Concern?

Yes, the United States Debt Clock is a cause for concern, particularly if left unaddressed. High levels of debt can lead to increased interest payments, crowding out other government priorities. Moreover, excessive borrowing can erode investor confidence, potentially leading to higher interest rates and reduced economic growth. However, by implementing sound fiscal policies and promoting economic stability, the risks associated with the debt clock can be mitigated.

Read also:Moolala Frozen Yogurt Menu A Comprehensive Guide To Your Favorite Treat

What Are the Long-Term Implications of the United States Debt Clock?

The long-term implications of the United States Debt Clock are significant. As the debt continues to grow, the government may face challenges in funding critical programs such as Social Security, Medicare, and national defense. Additionally, rising interest payments could divert resources away from investments in education, infrastructure, and research. These factors could hinder economic growth and reduce the standard of living for future generations. Proactive measures are needed to address these potential consequences.

How Can Citizens Stay Informed About the United States Debt Clock?

Citizens can stay informed about the United States Debt Clock by regularly monitoring credible sources of economic data and analysis. Websites such as the U.S. Department of the Treasury and the Congressional Budget Office provide detailed information on the nation’s fiscal health. Additionally, engaging in discussions with policymakers, attending town hall meetings, and participating in civic organizations can help raise awareness about the importance of addressing the debt clock.

What Steps Can Policymakers Take to Address the United States Debt Clock?

Policymakers can take several steps to address the United States Debt Clock. These include:

- Implementing comprehensive tax reform to increase revenue

- Reducing unnecessary government spending

- Promoting economic growth through investments in education and infrastructure

- Encouraging bipartisan cooperation to develop long-term fiscal solutions

What Role Does the United States Debt Clock Play in Global Finance?

The United States Debt Clock plays a significant role in global finance, as the U.S. economy is intricately linked to international markets. Rising debt levels can impact investor confidence, affecting global capital flows and currency exchange rates. Additionally, the U.S. dollar’s status as a reserve currency means that the debt clock has implications for countries holding significant amounts of American debt. Managing the debt clock responsibly is essential for maintaining the U.S.’s position in the global financial system.

How Does the United States Debt Clock Affect Everyday Americans?

The United States Debt Clock affects everyday Americans in numerous ways. High levels of debt can lead to increased taxes, reduced government services, and higher interest rates on loans and mortgages. Additionally, the debt clock can impact job creation and wage growth, as businesses may face higher borrowing costs. By understanding the implications of the debt clock, citizens can advocate for policies that promote fiscal responsibility and economic stability.

What Can Individuals Do to Address the United States Debt Clock?

While individuals may not have direct control over the United States Debt Clock, they can contribute to addressing the issue in several ways. Engaging in discussions about fiscal policy, supporting candidates who prioritize responsible budgeting, and advocating for transparency in government spending are all important steps. Additionally, individuals can educate themselves about the economic factors contributing to the debt clock, empowering them to make informed decisions about their financial future.

Conclusion: The Path Forward for the United States Debt Clock

In conclusion, the United States Debt Clock represents a critical challenge for the nation’s economic future. By understanding its causes, implications, and potential solutions, citizens and policymakers can work together to address this pressing issue. While the task may seem daunting, a commitment to fiscal responsibility and economic growth can pave the way for a more sustainable and prosperous future. As the debt clock continues to rise, it serves as a reminder of the importance of proactive and informed decision-making in shaping the nation’s fiscal destiny.

Table of Contents

- What is the United States Debt Clock?

- Why Should You Care About the United States Debt Clock?

- How Does the United States Debt Clock Work?

- What Are the Main Causes of the United States Debt Clock’s Growth?

- Can the United States Debt Clock Be Reduced?

- Is the United States Debt Clock a Cause for Concern?

- What Are the Long-Term Implications of the United States Debt Clock?

- How Can Citizens Stay Informed About the United States Debt Clock?

- What Steps Can Policymakers Take to Address the United States Debt Clock?

- What Role Does the United States Debt Clock Play in Global Finance?